Article originally published in Russian by Sphere, Oil & Gas magazine in October 2020

Written by Andrejs Siderenko Regional Sales Manager for Russia and CIS at Atmos International

The problem of environmental pollution and its implications for companies reliant on the refining industry has acquired a new dimension. The Russian media covered for the first time the fallout from a petroleum spill in Krasnoyarsk Region in 2020. Potential damages and the cost of the clean-up effort are already estimated to run into hundreds of millions of dollars. All pipelines find themselves in the immediate risk zone.

A leak may occur as a result of natural anomalies, corrosion or human interference (a recent example being the illegal siphoning of a pipeline in Mexico City that claimed 73 lives in 2019). According to the leak detection website prosou.ru, the past six months have seen some major petroleum spills that affected water bodies among other natural assets. The aging infrastructure inspires little hope that leaks will stop all of a sudden. The clean-up bill that pipeline companies will have to foot depends on how fast a leak or siphoning attempt has been detected.

Transneft has taken a no-nonsense approach to this issue on account of the fairly large pipeline transportation volumes and the attendant risks. The company developed detailed protocols for transmission pipeline leak detection systems. It maintains a single register of suppliers that is open exclusively to trusted vendors.

Other suppliers and pipeline operators must have an LDS (leak detection system) in place as an eligibility requirement. Smaller companies have treated the matter of leak detection as an afterthought until now. It’s a common myth that there are no effective leak detection systems.

That’s why the cheapest systems are installed since the lowest-priced bid always wins the competitive selection process. As a result, the LDS market has turned into a Wild West of sorts where any Tom, Dick or Harry can rig up and market a product, leaving it entirely to the pipeline operator to ward off any leak problems.

The sooner a leak gets detected, the less impact there is for the environment and the company’s bottom line. Only operators that mean business use this approach, realizing that their choice of an LDS spells a specific amount of losses should this choice prove wrong. This brings us to the main subject of this article. How does one approach the matter of an LDS and avoid problems in the process?

Supplier evaluation

Unfortunately, the situation in the Russian LDS market is far from healthy. This is because the centralized regulation of this area is non-existent. Major companies prefer to issue a protocol of their own. Apart from the standard competitive selection process evaluation, there are no criteria for choosing an LDS supplier.

Common sense suggests several possible criteria;

First, in evaluating the status of a company offering an LDS, one should preferably look at its track record or list of solutions deployed. It’s a good sign if they have international projects. They (and the host country) are an immediate indicator of the company’s standing in the global ranking. If there are few deployments, this begs the question: How reliable is the system? In all likelihood, the low price and not the product itself helped secure the winning bids.

Second, one should preferably evaluate the company’s core business stream. What is its main line of business? If it’s automation, fine. If it’s control systems, even better. But what do they have to do with leak detection systems? Apart from the technical aspect: conveying signals to the LDS server for analysis. What kind of software do they run? Large companies normally buy up existing LDS businesses. Whatever remains of their LDS operations afterward is anyone’s guess. Buyers are naturally swayed by the reputation of a flagship company. They believe in promises of best-in-class engineering support. But such support centers specialize in automation and seldom in LDS.

Hence the conclusion that only specialist companies that offer leak detection systems as their core businesses stream can be trusted. This offers buyers flexibility when it comes to choosing equipment without getting tied down to integrated solutions of our foreign ‘partners’ who can disable control with a flip of a switch. Corporate security services should be aware that an LDS is an alert system and not a control system. It cannot influence the operation of a pipeline. By choosing a major integrated (non-Russian) provider and entrusting it with all telemechanics as part of a ‘cost-effective all-in-one solution’, operators expose themselves to risks of compromised security.

Third, one should answer the question of whether the system has been tested on other pipelines and how reliable it is. A demo performance during acceptance testing is one thing. Yet the operator needs the system to run without fail for decades. There’s no telling how the product will behave several years down the road. There are countless examples of systems passing acceptance tests with flying colors only to fail when the one-year warranty runs out. When the operator asks why this happened, the vendor replies that the system requires ongoing maintenance. Notably, the annual maintenance fee is up to one half of the original delivery price. The buyer effectively ends up with a manual system that cannot operate without human involvement.

There are numerous other pitfalls when it comes to choosing an LDS. And yet the primary quality criteria for this product were formulated as far back as the 1990s.

International practices

When it comes to ownership, a capitalist mindset prevails in the West. If things do not go as planned, pipeline operators face hefty fines and may have their licenses revoked in several cases. That’s why a reasonable pipeline owner will never look for a cheaper solution but will instead consult an industry-written standard. A relevant example of international practices is Germany with its TRFL standard that requires installing two independent leak detection systems on a pipeline. Notably, they should be mutually independent. Unless this condition is met, the operator company will not be licensed to run a pipeline.

The American Petroleum Institute (API) is the leading and best-known pipeline transport standardization authority. It handles the bulk of the research that identifies the best industry practices. Historically, as the era of personal computers began and computing capacities evolved in the 1990s, operators discovered an opportunity to download and process hydraulic data of pipelines in real-time (online). The first edition of the API 1130 standard (Computational Pipeline Monitoring) appeared in 1995 as a product of painstaking research that analyzed all methods available at the time, causes of petroleum spills and the effectiveness of leak detection practices. This standard regulates the operation of leak detection systems based on computational pipeline monitoring methods.

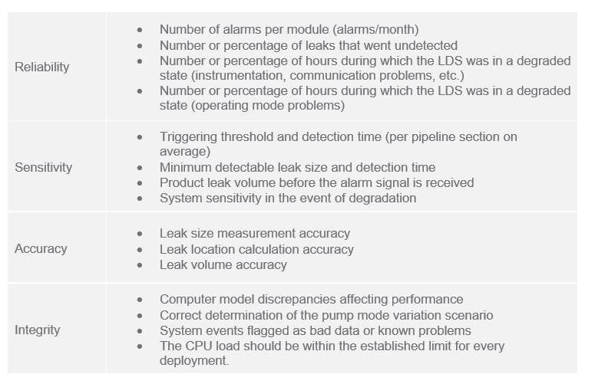

API 1130

The criteria of this standard are four key parameters of any leak detection system based on computational analysis of incoming pipeline hydraulic data:

- Reliability - the ability of the system to continuously detect leaks in all operating modes without false alarms.

- Integrity - the ability of the system to detect leaks even when telemetry signals are lost.

- Sensitivity - the smallest leak that the system is capable of detecting without causing false alarms.

- Accuracy - the ability of the system to identify the leak location (and, in some cases, the extent of the leak) with the requisite amount of precision.

In other words, pipeline software developers have been using this standard as a yardstick since 1995.

Over the years, the following methods based on pipeline hydraulic state analysis have been developed:

- Mass balance

- Negative pressure wave

- Pressure gradient

- Transient model

- e-RTTM - extended real-time transient model

- Statistical mass balance

- Acoustic correlation

- Infrasound correlation

- In addition to these techniques, external leak detection methods have been also used:

- Vapour pick-up tubes

- Optical fiber cable distributed temperature sensor (DTS)

- Optical fiber cable distributed acoustic sensor (DAS);

- Infrared cameras

- Biological monitoring (canine patrols)

- Unmanned aerial vehicles

This article does not aim to analyze these methods. Suffice to say that every detection method has its merits and shortcomings. Many companies have managed to develop and implement their systems over two decades. The world has accumulated a sufficient LDS knowledge base through trial and error as various methods were tested. Many consulting companies have amassed enough knowledge about the benefits and flaws of specific approaches. This brings us to the question: What’s next?

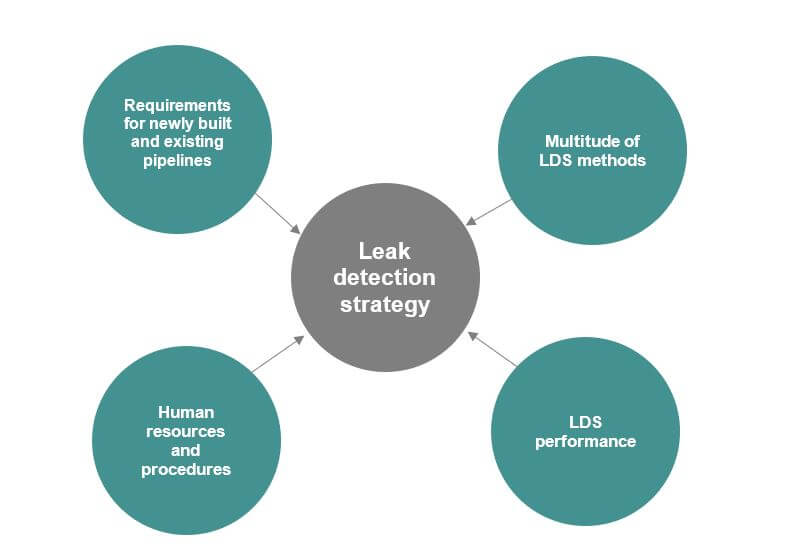

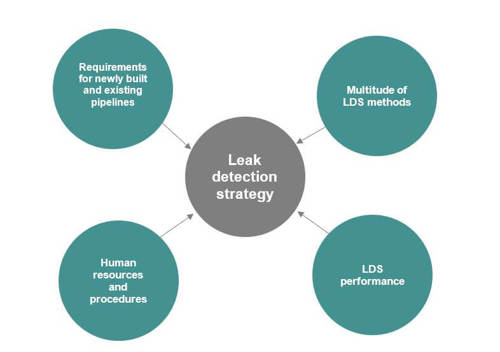

The annual API conference in New Orleans in November 2015 featured a report on newly developed leak detection recommendations. The API 1175 recommendations are a logical continuation of efforts to standardize leak detection systems for pipelines carrying liquid products all over the world.

Looking into the Future with API 1175

It is safe to say that API 1130 is a standard governing LDS engineering and deployment, while API 1175 is a collection of recommendations on choosing, maintaining and upgrading leak detection systems.

Incidentally, there is also an addition to API 1130 - API 1149, which complements the LDS computational methods.

Countless leak detection methods have been tested for over 20 years. Companies developed them in-house or made their pipelines available for R&D efforts of research institutions that won grants.

The key provisions of the recommendation are centered on:

- More advanced requirements for pipeline leak detection

- The need to continuously improve existing systems

- Areas of the highest criticality or risk (nature reserves, rivers, etc.)

- LDS performance

- Risk assessment processes

The main purpose of the recommendations is to introduce the concept of key performance indicators (KPIs) of an LDS. The operator responsible for the trouble-free operation of the pipeline should know the weak spots of its monitoring system and implement improvement processes.

The existing LDS parameters (API 1130) should be improved regularly. The recommendations use computational and observational methods to establish sensitivity metrics.

Examples of LDS performance metrics:

The system should generate a full status report and highlight the causes of abnormal operation.

Full-scale detailed procedures for responding to a leak signal should be in place.

Personnel roles in the event of abnormal operation should be allocated and training should be provided.

Management of LDS maintenance involves regular system analysis (daily, weekly, monthly). Long term analysis focuses on LDS performance over a long period (3, 5, 10 years). Leak tests must be carried out regularly.

Change management

Changes involve improving the LDS configuration over the long term while also maintaining balance.

Targets must be set: the minimum triggering threshold and sensitivity.

Other targets may be set if specific targets cannot be achieved.

- New instrumentation and measuring devices

- Improved communications

- New adjustment technologies

- Operating mode changes

Plans to improve the current status and processes

Key objectives for the LDS:

- Setting the goal to achieve the best LDS performance

- Measuring current LDS performance using KPIs

- Demonstrating security improvements and risk mitigation (continuous improvement)

- Performance indication

- Detection of new threats

The key provisions of this recommendation can be generally used by Russian pipeline companies and industry institutions to develop a comprehensive document governing LDS implementation.

Operator companies can look into the possibility of enhancing control over their pipeline fleet by systematizing their practices and reporting on the quality of leak detection systems installed on their pipelines. By assessing the key performance indicators, they can sort out the weaknesses and strengths of such systems and avoid mistakes when choosing them in the future.